The global insurance market is undergoing its most significant transformation since the invention of auto insurance, fueled by on-demand micro-policies that cater to gig workers, digital nomads, and Gen Z consumers. By 2025, the on-demand insurance market is projected to reach $10.7 billion, growing at a 28% CAGR, as traditional annual policies give way to pay-per-use coverage for everything from hourly rental car insurance to single-event drone coverage.

This comprehensive guide explores how gig economy trends, hyper-personalization, and AI-driven underwriting are reshaping insurance—and what it means for consumers, insurers, and investors.

1. Why On-Demand Insurance Is Exploding in Popularity

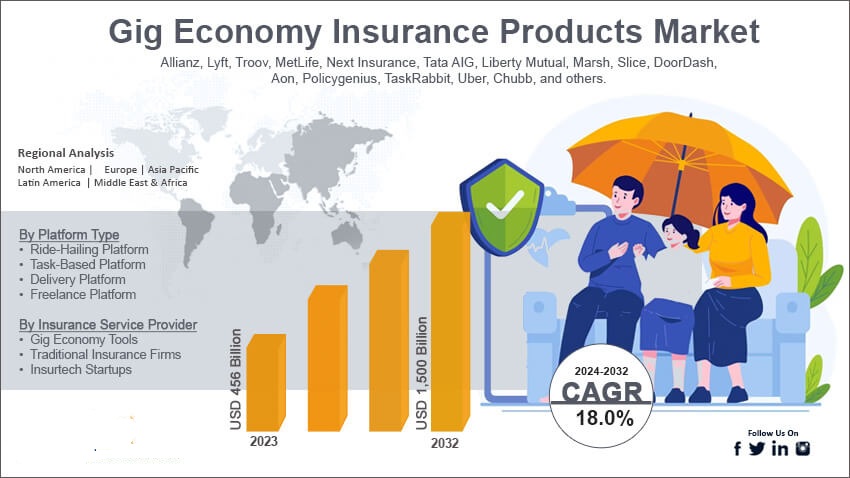

A. The Gig Economy Effect

- 76 million Americans now freelance (Upwork 2024)

- Top demands:

- Rideshare gap coverage (between Uber trips)

- Equipment insurance for Taskers (by the job)

- Health stop-loss policies for contract workers

B. Gen Z’s “No Commitment” Mindset

- 57% prefer pay-as-you-go over annual contracts (Deloitte)

- Top purchases:

- Phone damage insurance (by the day)

- Travel medical (per trip)

- Pet injury coverage (for dog-walking gigs)

C. AI Makes Micro-Policies Profitable

- Dynamic pricing: Rates adjust in real-time based on:

- Weather data

- Location risk scores

- User behavior (e.g., dashcam feeds)

2. The On-Demand Insurance Landscape (2025)

A. Top Categories & Market Leaders

| Segment | Leader | Innovation |

|---|---|---|

| Rideshare | Slice | Minute-by-minute coverage |

| Travel | Sure | Airbnb host liability by stay |

| Electronics | Toggle | Phone insurance activated via app |

| Health | Bind | On-demand specialist visits |

B. How Pricing Compares to Traditional Policies

| Coverage Type | Annual Policy | On-Demand | Savings |

|---|---|---|---|

| Rental Car | $480/year | $1.50/hour | 92% |

| Camera Gear | $220/year | $5/day | 85% |

| Event Cancellation | $150/year | $10/event | 93% |

3. The Technology Enabling the Boom

A. Blockchain Smart Contracts

- Auto-claims processing (Lemonade’s 3-second payouts)

- Dynamic policy adjustments (e.g., hiking premiums during hurricanes)

B. IoT Integration

- Real-time driver monitoring (Metromile)

- Smart home sensors lowering homeowners’ premiums

C. AI Underwriting Engines

- Zest AI: Approves policies in 11 seconds

- Shift Technology: Detects fraud during signup

4. Challenges & Controversies

A. Regulatory Gray Areas

- State-by-state approval delays

- “Insurance-as-a-service” loopholes

B. Data Privacy Concerns

- Location tracking requirements

- Social media scraping for risk scoring

C. Profitability Questions

- Customer acquisition costs vs. micro-premiums

- Adverse selection risks

5. The Future of On-Demand Coverage

A. Embedded Insurance

- Tesla offering real-time collision coverage

- Amazon deliveries with automatic parcel insurance

B. Parametric Policies

- Auto-payouts when:

- Flight delays exceed 2 hours

- Rainfall > 1″ in 24h

C. Fractional Ownership Models

- Shared yacht/art collections with usage-based premiums

Conclusion: Is Your Business Ready?

Consumers should:

✅ Audit wasted annual premiums

✅ Try on-demand alternatives for infrequent needs

Insurers must:

✅ Partner with gig platforms

✅ Invest in real-time underwriting AI